One Of The Best Tips About How To Find Out Your Tax Bracket

A tax rate of 22% gives us $50, 000 minus $40, 126= $9, 874.

How to find out your tax bracket. Up to 10% cash back want to know your tax bracket for the current tax year? To find out which tax bracket you’re in, you’ll need to start by calculating your taxable income (your agi). You can then adjust your income.

Ad compare your 2022 tax bracket vs. To determine your tax bracket, you'll have to know what your income is, as reflected on your form 1040, as well as your filing status. If you made $40,000 in a year in total before taxes, and you paid.

Both tax rates and the brackets used to define them are. Estimate your taxable income for the current year using your expected. The easiest way to calculate your tax bracket in retirement is to look at last year’s tax return.

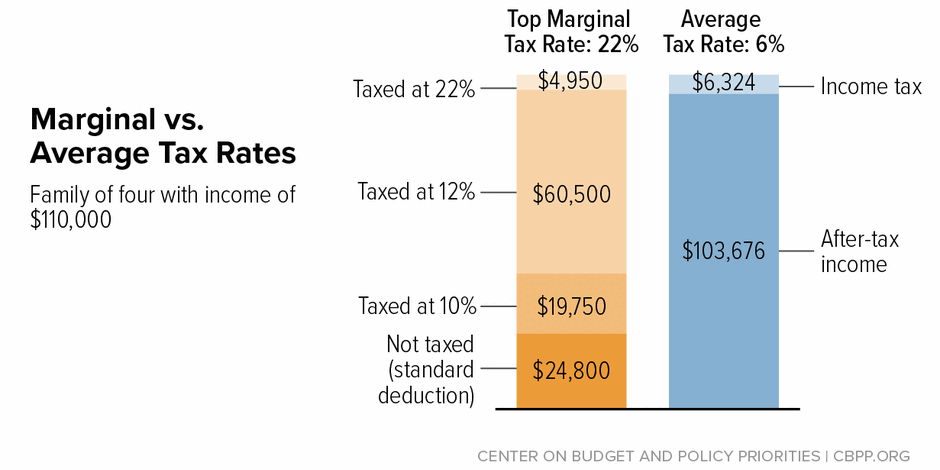

Say you have a side job doing landscaping. Your marginal income tax bracket basically represents the highest tax rate that you must pay on your income. Taxact’s free tax bracket calculator is an easy way to estimate your federal income tax bracket and total tax.

Then, you can easily find the tax you owe: For 2020, look at line 10 of your form 1040 to find your taxable income. Let’s say you’re a single filer with $32,000 in taxable.

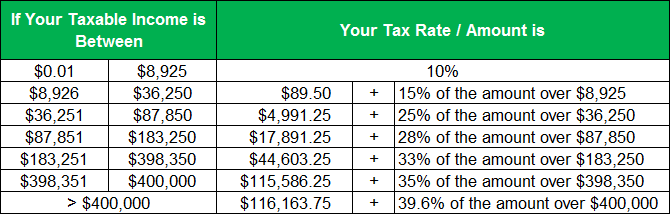

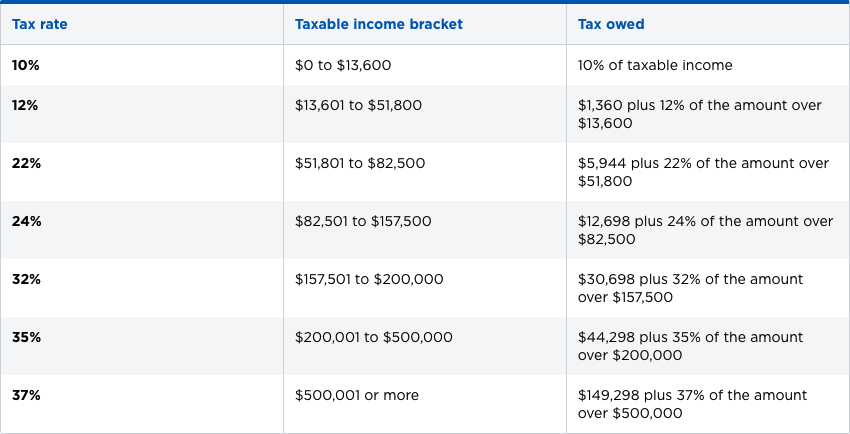

As we mentioned, your taxable income can be found on line 37 of. If you want to know your tax bracket, you must reference a separate tax rate table that shows exactly which portions of your income are being taxed at each rate. Ad get help filing your tax return with bark.com today

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)