Brilliant Tips About How To Settle Debt For Less

If you go this route, ask the auto.

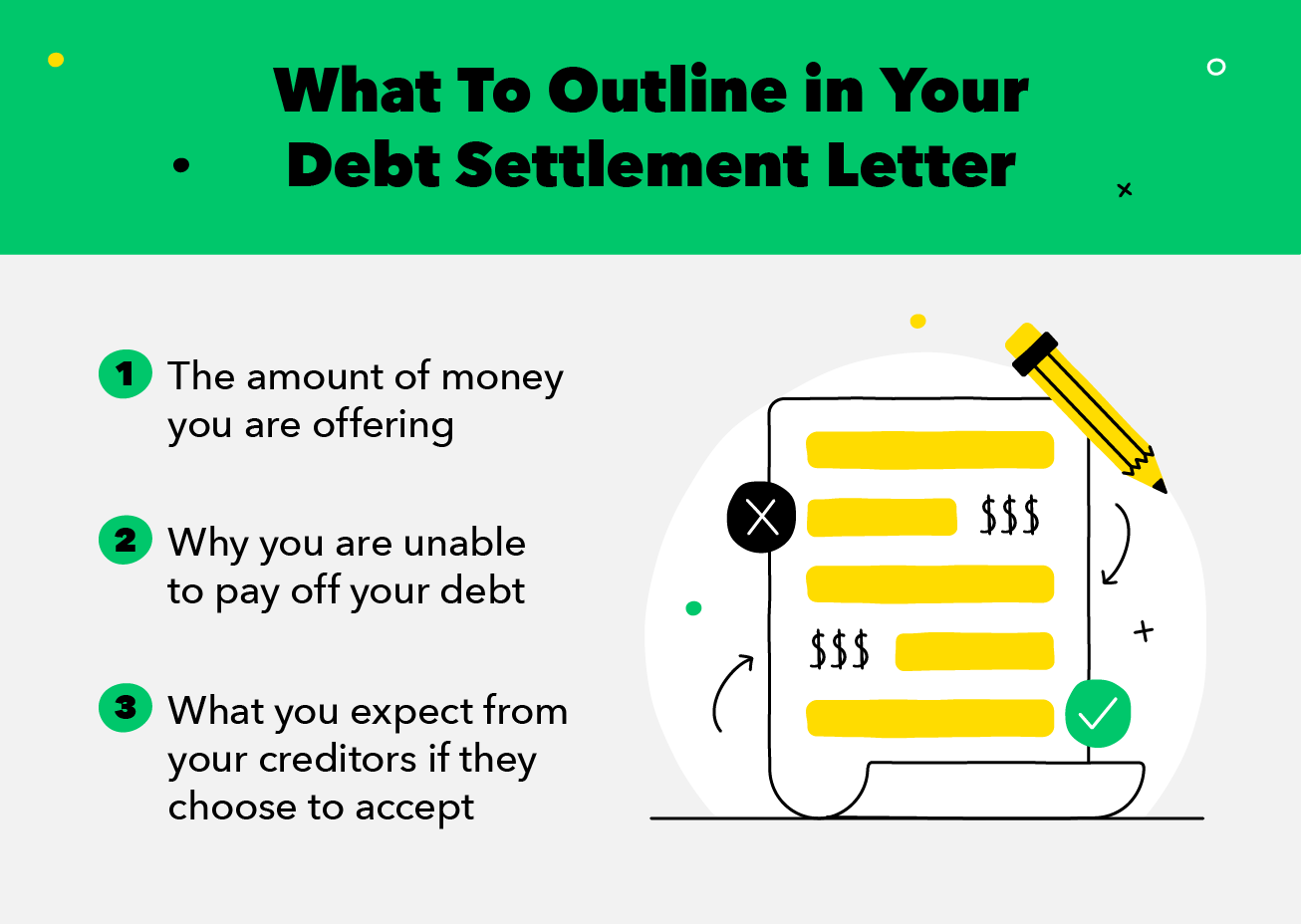

How to settle debt for less. Debt settlement is when either you or a third party negotiates with a creditor to pay off your debt for less than you owe. The final step to settle your debt is to get a written agreement with the creditor. They typically offer less than the initial transaction.

Ad avoid bankruptcy and revive your credit! Here's what you need to know before you move. Compare offers for your best rate and lowest monthly payment.

Write down a summary of. Financial relief with americor funding. Get a free quote from a certified debt consultant!

Debt settlement happens when the creditor, or the person you owe, decides to accept less than the total amount you owe them. While it's generally better to settle a debt before there is a. Scrutinize your finances to see how much cash you can get your hands on when the time comes to negotiate a.

Ad receive personalized loan offers in moments. Usually, this happens when you offer to settle. Best practices when settling debts 1.

Review your debt priorities first, as falling behind on other bills because you are. How to settle your student loan debt. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal.